A BRIEF HISTORY

The year is 1947. Top on the pop charts is Woody Guthrie’s This Land is Your Land. Jackie Robinson becomes the first African American to play major league baseball, and Chuck Yeager the first person to fly faster than the speed of sound.

In the same year, the American Institute of Certified Public Accountants decided they wanted to bring Life Insurance benefits to employees of CPA firms. So, they formed the AICPA Insurance Trust partnering with

The Prudential Insurance Company of America (Prudential), as the carrier for the products, and Aon, as the insurance broker and Program Administrator.

“They used the Insurance Trust to collect premiums, pay claims and expenses, and when there were funds left over, it was given back to the firms as an Annual Cash Refund to help reduce their costs,” said Mark Thomas, CLU, ChFC, senior vice president of Aon Insurance Services.

The Annual Cash Refund remains unique in the industry. Annual Cash Refunds may help lower your firm's cost of insurance. The AICPA Group Insurance Trust (Trust) reviews a number of factors in determining the amount, if any, of Annual Cash Refunds, such as premiums, claims, expenses, and other charges. These refunds vary year to year and are not guaranteed. The Trust has paid Annual Cash Refunds to firms since 1949. The Trust may suspend the distribution of Annual Cash Refunds at any time. These refunds could vary based on the premium your firm pays, and when premiums are lowered, refunds may decrease as well. Over time the Group Insurance Plan (GIP) became so popular, the AICPA began opening the Trust to their members to purchase individual life policies.

SHARING OUR GIP DATA

To assist firms in making smart decisions when it comes to providing Group Life benefits to their employees, in this paper Aon is sharing our GIP proprietary data. It is our hope that sharing this information will help guide CPA firms in designing their own employee Group Life Insurance program.

GIP: DESIGNED FOR SMALL CPA FIRMS

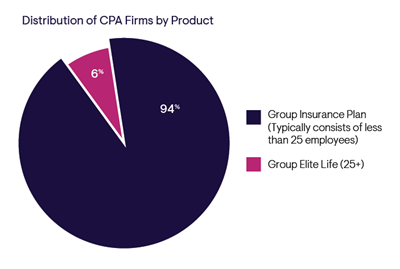

Aon administers two AICPA-endorsed Group Life Insurance programs for CPA firms: the Group Insurance Plan (GIP) and Group Elite Life. Eligibility depends on firm size. The GIP is designed for firms typically consisting of less than 25 employees and Elite for firms with 25 or more employees. Together they cover more than 3,600 CPA firms and more than 40,000 lives.

Source: Group Life Analysis, AICPA Member Insurance Programs, Aon, July 31, 2023.

Most of the firms insured through AICPA-endorsed Group Insurance Plan have fewer than 25 employees. This reflects two things: 1) there are a lot of CPA firms with less than 25 employees, and 2) the marketplace does not serve small firms very well.

“That’s where the AICPA Member Insurance Programs have stepped in and done just a great job,” said Thomas. “We’re giving small firms access to Life Insurance as a benefit for their employees and we’re doing it at an affordable cost.”

CPA firms often struggle to find an insurance carrier willing to offer benefits to a smaller firm and it makes it hard to compete for employees. Thanks to the CPAs that decided it would be a good idea to offer Life Insurance through a Trust, small firms now have access to very competitively priced Plans.

BENEFIT AMOUNT BY SALARY

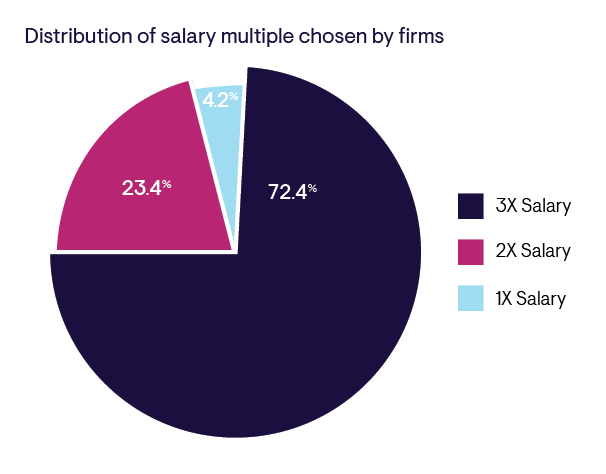

Firms may elect to provide their employees with an amount of Life Insurance that is 1X, 2X or 3X their salary. Three out of four firms enrolled in the GIP opt for the highest multiple of coverage.

.png?width=400&height=312)

Source: Group Life Analysis, AICPA Member Insurance Programs, Aon, July 31, 2023.

POPULAR COVERAGE LIMITS

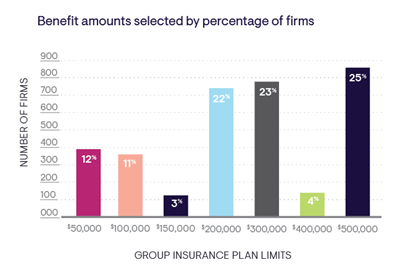

The GIP offers employees Life Insurance limits that range from $50,000 to $500,000. When looking at the limits selected by the 3,374 firms enrolled in GIP; $200,000, $300,000 and $500,000 are the most popular benefit amounts.

Source: Group Life Analysis, AICPA Member Insurance Programs, Aon, July 31, 2023.

- If a firm wants to keep their costs lower, they only have to provide employees with $50,000 of Life Insurance.

- Partners can have the maximum of $500,000 regardless of their salary amount. Most firms will cover their partners at this limit.

DEPENDENT COVERAGE

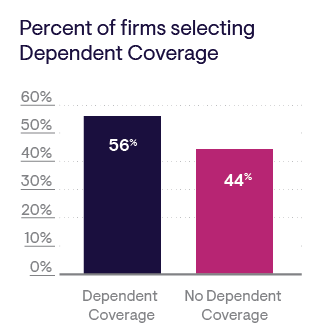

Dependent coverage is optional on the GIP. When selected, it is received by every employee. Dependents include spouses and all children. Spouses receive 25% of the employee’s benefit amount up to a maximum limit of $25,000. Children each receive $10,000 of coverage.

Source: Group Life Analysis, AICPA Member Insurance Programs, Aon, July 31, 2023.

- Dependent coverage is a blanket coverage. If an employee gets married or has a baby, they don’t need to call to add their spouse or child—they are covered automatically.

- There is no medical underwriting for dependents. If a firm hires an employee whose spouse is in poor health, they are guaranteed coverage under the GIP.

WAIVER OF PREMIUM AND AD&D

Whereas Waiver of Premium and Accidental Death & Dismemberment (AD&D) coverage are typically optional on most group and individual life insurance plans, on the GIP they are built into the cost. All firms enrolled in GIP received these benefits.

- Disability Waiver Feature: If an insured becomes totally disabled before age 60, Life Insurance coverage will be extended at no cost while the insured remains totally disabled. As long as the disability continues, and periodic proof of disability is furnished, the death benefit protection will be extended from year to year while the premium is waived. (This extension of coverage does not apply to Dependent coverage).

- AD&D: Accidental Death & Dismemberment is sometimes called ‘double indemnity.’ If the employee dies in an accident they receive 2X the face amount of their coverage. The dismemberment portion of the coverage pays specified amounts for lost limbs, such as feet and hands, or the permanent loss of sight.

STACKED COVERAGE AVAILABLE

In addition to their group coverage, a CPA can buy up to $2.5 million of Individual Life Insurance through the AICPA Member Insurance Programs.

“If they are a member, partner, or owner of a smaller CPA firm insured in the Group Plan, they can get up to $500,000 of group coverage. That’s in addition to their individual coverage, so between the two Plans they can get up to $3 million of total coverage,” said Thomas.

CONVERSION PRIVILEGES

If an employee leaves the firm or their coverage is reduced, they have the option to convert their Group Plan coverage to an Individual Prudential policy within 31 days of the termination/reduction date, guaranteed, regardless of their health.*

ACCOUNT MANAGEMENT PORTAL

The most recent enhancement to the GIP is the release of an easy-to-navigate Group Account Management (AMP) portal.

“We’re getting a lot of positive feedback,” said Thomas. “Firms love AMP. It’s clear, concise. Very user friendly. They can administer their whole program online, without the need for paper. We email out a monthly reminder at the beginning of the month that says updates are complete, and they can go online and make a payment.”

This new portal gives firm partners and administrators the following capabilities:

- View and pay your bill online

- View a roster of participating employees/partners

- Easily add/terminate employees/partners at any time

- Update firm information

- Update firm preferences, including how to receive your Annual Cash Refund

- Download forms, such as Beneficiary Change Forms

- Start selected claim processes

Firm admins also receive more visibility into the status of their employees. The portal dashboard shows them how many active employees they have, which employees are pending underwriting, and which employees have yet to complete their applications.

PRUDENTIAL’S ROLE

Coverage under this Plan is issued by The Prudential Insurance Company of America.

“Prudential does the underwriting and assesses everyone's eligibility.” said Thomas. “They pay out the claims and the expenses. Whatever is left over is given back to the AICPA Insurance Trust and distributed to insured members in the form of the Annual Cash Refund.”

INTANGIBLES

One of the GIP’s most valuable benefits is the team supporting it.

Ready to start designing your own Group Insurance Plan? Visit

cpai.com

Talk to an AICPA Advisor today.

Disclaimer

*Please see the Group Policy for more information on your conversion rights.

This policy provides ACCIDENT insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

IMPORTANT NOTICE – THIS POLICY DOES NOT PROVIDE COVERAGE FOR SICKNESS.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

Not for use in New Mexico.

Not for residents of New Mexico.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc., a licensed producer in all states (TX 13695); (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc., (CA 0G94493), Aon Direct Insurance Administrators and Berkely Insurance Agency and in NY, AIS Affinity Insurance Agency. If you have questions on the Group Insurance Plan, please contact the Plan Agent: Aon Insurance Services, 1100 Virginia Drive, Suite 250, Fort Washington, PA 19034-3278, 1.800.223.7473.

The Plan Agent of the AICPA Insurance Trust, Aon Insurance Services, is not affiliated with Prudential.

Group Insurance coverage is issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. CA COA #1179, NAIC #68241 Contract Series: 83500.

© 2023 Prudential Financial, Inc. and its related entities.

1024898-00004-00