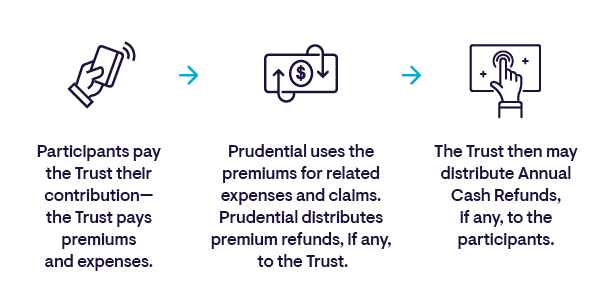

The AICPA Trust Life, Disability, and Group Variable Universal Life (GVUL) Plans, issued by The Prudential Insurance Company of America (Prudential), can offer insurance protection at affordable rates and the opportunity for Annual Cash Refunds.

Annual Cash Refunds may help lower your cost of insurance. The AICPA Insurance Trust (Trust) reviews a number of factors in determining the amount, if any, of Annual Cash Refunds, such as premiums, claims, expenses, and other charges. These refunds vary year to year and are not guaranteed. The Trust has paid Annual Cash Refunds every year since each Life Insurance Plan's inception, and since 1984 for each Disability Insurance Plan. However, the Trust may suspend the distribution of Annual Cash Refunds at any time. These refunds could vary based on a number of factors, such as your rate class, payment mode, and the premium you pay. Please note, when premiums are lowered, refunds may decrease as well.

Annual Cash Refund News for 2026

- The Annual Cash Refund was distributed on February 23rd.

- This year’s Annual Cash Refund is over $166.5 million distributed to over 126,000 members for both Trusts combined.

- Over 79,000 members will have immediate access to their Annual Cash Refund through electronic deposit.

- Click to view the Committee Report with Annual Cash Refund percentages and Trust Refund FAQs.

- Conveniently access your Annual Cash Refund Statement/Schedule K-1 online by logging in.

Annual Cash Refund Options May Add More Money to Your Annual Cash Refund

- A member’s Annual Cash Refund may be increased by $25 if the member has more than one Trust product.

- For participants making monthly Electronic Fund Transfer payments, the Annual Cash Refund basis may be increased by $25.

- The Annual Cash Refund may be reduced by $6 for participants with Dependent Child Coverage.

ACH Option Results in Faster Annual Cash Refund Delivery

If you haven’t done so already, sign up for ACH and have future Annual Cash Refunds deposited to your savings or checking account the day they become available. To thank policyholders for registering for electronic deposits, a one-time $25 increase may be added to your Annual Cash Refund in the year in which you successfully enroll. Sign up using these three easy steps:

- Go to trustmyaccount.cpai.com.

- Choose “Annual Refunds;” select “Annual Refund Preferences;” select “Update Preference”.

- Choose “Electronic Bank Deposit/ACH;” fill in your banking information.

PLEASE NOTE– The participant receiving their Annual Cash Refund by check acknowledges and agrees that in order to obtain the Annual Cash Refund, if any, all Annual Cash Refund checks must be presented for payment according to the terms and procedures set forth in this paragraph. Without limiting the foregoing, Annual Cash Refund checks shall be deemed null and void if not duly presented for payment by, or on behalf of, the participant or former participant by the expiration date (not to be less than 120 days from the date of issuance) set forth on the face of the check. If a participant fails to timely present for payment an Annual Cash Refund check according to this provision and has not, prior to the expiration of the initial Annual Cash Refund check, requested re-issuance of such check, the full amount of the Annual Cash Refund shall be applied toward any of the participant’s contribution payments due; if no contribution payments are due or owing by the participant at the time the Annual Cash Refund check expires, the Annual Cash Refund amount shall be applied toward future contributions as they become due, until the participant receives the full Annual Cash Refund amount. Except as otherwise provided in this agreement, upon termination of coverage under the applicable trust, nothing herein shall limit a participant’s right to receive a full Annual Cash Refund of any unearned contributions or unapplied portion of expired Annual Cash Refunds. For Participants receiving their Annual Cash Refund by ACH, if we are unsuccessful in transmitting the Annual Cash Refund to the bank account we have on file, we will issue the Annual Cash Refund by check, which will follow the same rules noted above.

IMPORTANT NOTICE — Please visit www.cpai.com/mib.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

The products issued by The Prudential Insurance Company of America may not be available in all states.

Not for use in New Mexico.

Not for residents of New Mexico.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

This policy provides disability income insurance only. It does NOT provide basic hospital, basic medical or major medical insurance as defined by the New York Department of Financial Services.

THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

This material is for informational or educational purposes. In providing this material, Prudential (i) is not acting as your fiduciary as defined by the Employee Retirement Income Security Act of 1974, as amended, and the guidance and regulations issued by the Department of Labor and is not giving advice in a fiduciary capacity and (ii) is not undertaking to provide impartial investment advice as Prudential will receive compensation for its services/products.

GVUL—You should consider the coverage and the underlying funds’ investment objectives, risks, charges and expenses carefully before investing. Both the GVUL prospectus and the underlying fund prospectuses contain this and other important information. Visit cpai.com/gvulprospectus for the prospectuses. You should read them carefully before purchasing coverage.

Group Insurance coverages and Group Variable Universal Life (GVUL) coverage are issued by The Prudential Insurance Company of America; and, GVUL is distributed through Prudential Investment Management Services, LLC. Both are Prudential Financial companies, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. If there is a discrepancy between this document and the Booklet-Certificate/Group Contract issued by The Prudential Insurance Company of America, the Group Contract will govern. In Washington, the controlling document is the Certificate, not the Contract. Contract Series: 83500 & 89759.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc., a licensed producer in all states (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators, and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency. Securities offered through Aon Securities LLC, Member FINRA/SIPC, 1100 Virginia Drive, Suite 250, Fort Washington, PA 19034-3278, 1-800-223-7473.

1012734-00008-00 Ed 2/26