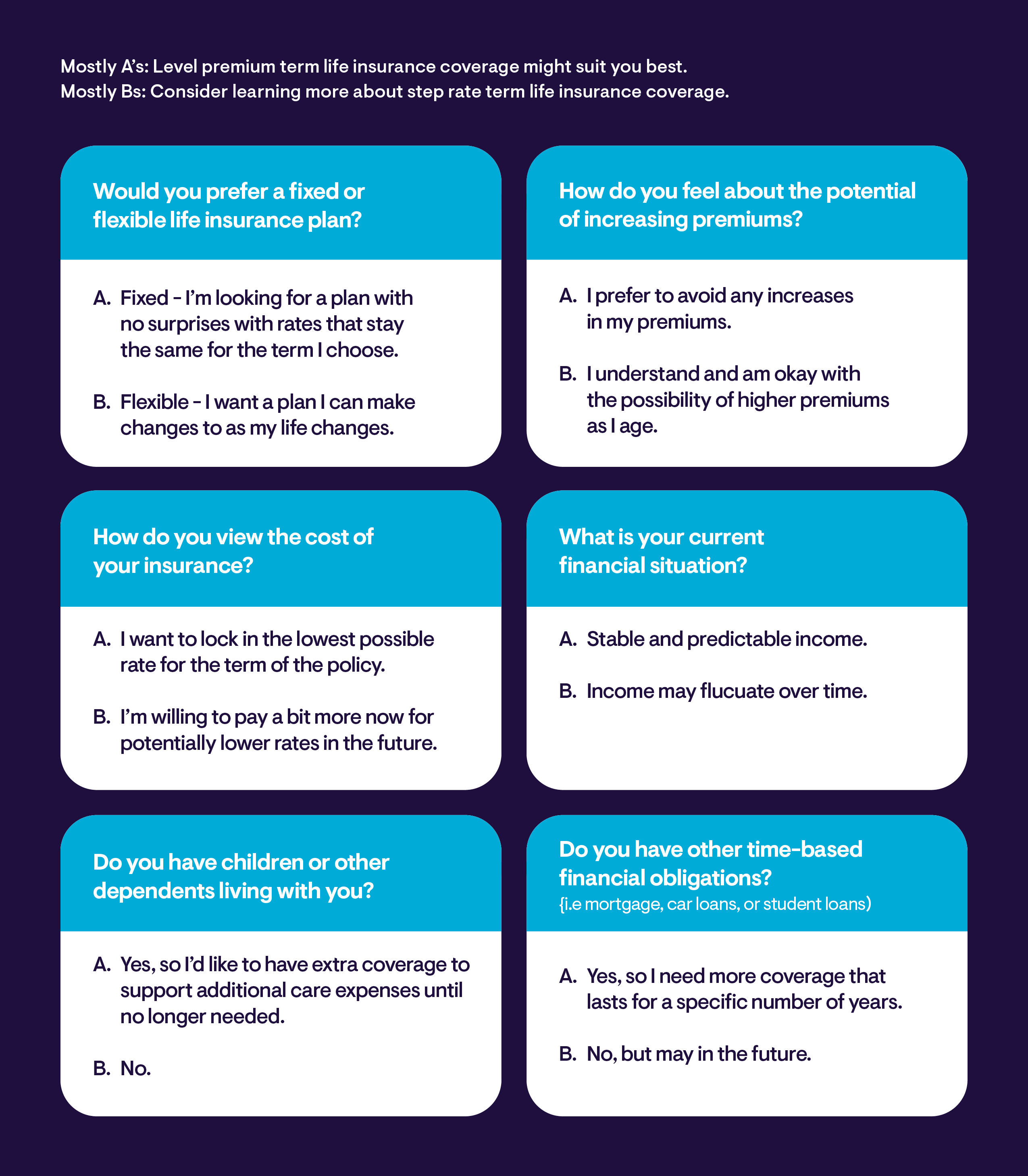

What are the differences between level premium and step rate term life insurance?

Level Premium Term life insurance

Rates that stay the same: Level Premium Term (LPT) life insurance offers steady rates for the length of the entire term period. This makes it an ideal option for long-term cost planning and budgeting, as the rates remain consistent regardless of your age and health.

Coverage for set terms: If you need coverage for a specific period, such as until your children are grown or your mortgage is paid off, LPT provides the stability and predictability you may need.

Opportunity for lower rates: The younger you are when you apply, the lower your rates will typically be, making it more cost-effective

Step Rate Term life insurance

The premiums for a step rate term policy start lower and increase as you age. This can be advantageous if you expect your income to grow over time, allowing you to manage lower initial costs.

Often requires ongoing proof of good health. This can affect your rate class eligibility and potentially lead to higher premiums if your health changes.

Longer terms: If you need coverage for a longer duration and are comfortable with the possibility of rate increases, step rate term life insurance might be an option for you.

*IMPORTANT NOTICE — Please visit www.cpai.com/mib.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA and MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators, and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency. The Plan Agent of the AICPA Insurance Trust, Aon Insurance Services, is not affiliated with Prudential.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ.

1086011-00001-00