As an accountant, you’re dedicated to helping your clients navigate their finances. But have you given the same level of attention to your own? Consider what would happen to your finances if an injury or illness prevented you from working. Disability insurance is a vital component of any financial plan, especially for CPAs who have invested significant time and money into their careers. Evaluating your financial needs and exploring policy options can assist you in finding the best coverage to help protect your financial and professional future.

What is disability insurance?

Simply put, disability coverage can be thought of as insurance for your paycheck. It is designed to help protect your income by providing monthly payments to help you keep up with daily expenses if you’re unable to work due to a disabling injury or illness. It is one of the best ways to help protect your future earning potential and provide you and your loved ones with added financial stability.

Why is disability insurance important for accountants?

Your income is your most valuable asset, supporting everything from mortgage payments to your child's college education. But what if an unexpected challenge, like a car accident, medical treatment, or mental health issues, prevented you from working? Disability insurance can help you prepare for these situations and protect your ability to earn an income as a CPA.

How does disability insurance work with health insurance and life insurance?

While health insurance covers medical expenses, it doesn’t help with mortgages, car payments, or daily expenses if you’re unable to work. Disability insurance steps in to provide a portion of your income and assist with expenses like these, helping you focus on recovery with less financial stress.

Even if you have life insurance to help protect your loved ones if you pass away, you should consider how they may be impacted if you’re unable to work and earn a paycheck. While life insurance is designed for those we leave behind, disability insurance helps protect your, and your family’s, current financial well-being.

What can disability benefits be used for?

Monthly payments from a disability plan can offer welcome relief by covering a portion of your income if the unexpected happens. This means you may be able to avoid using your hard-earned savings to manage your financial obligations if you become disabled.

The benefits from a disability insurance plan can be used to pay for your expenses while you set back on track, like your mortgage, car payments, medical bills, and more.

What common disabilities are covered by disability insurance?

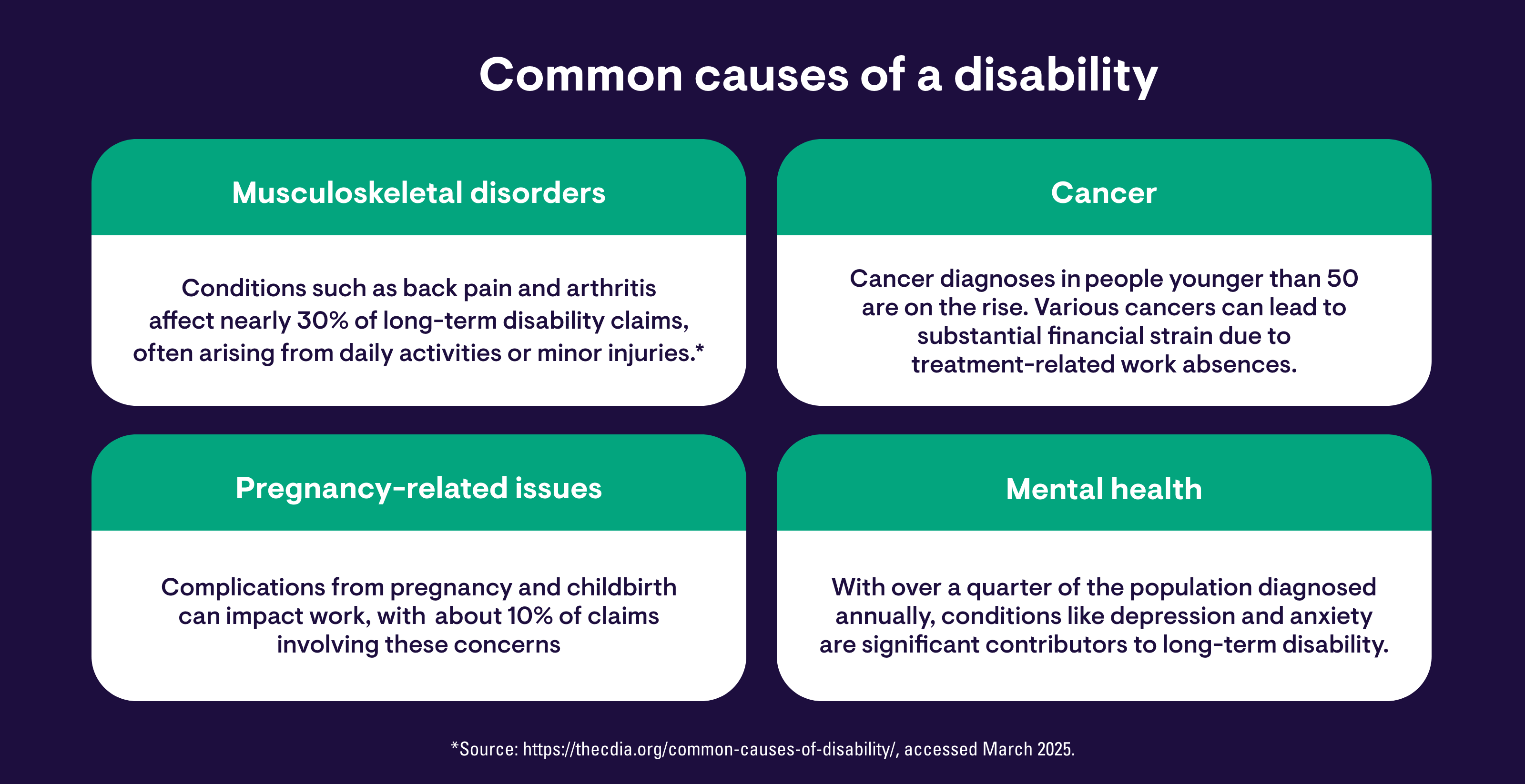

Many accountants believe becoming disabled could never happen to them due to the low-risk nature of their work. But the reality is that disabilities are more common than people realize. In the U.S., one in four 20-year-olds will become disabled before retirement age. This is why it's crucial to consider purchasing a disability plan to help protect your income.

Disability insurance can help cover a range of common disabilities including cancer, musculoskeletal issues, heart conditions, and mental health disorders.

What are the differences between short-term and long-term disability insurance plans?

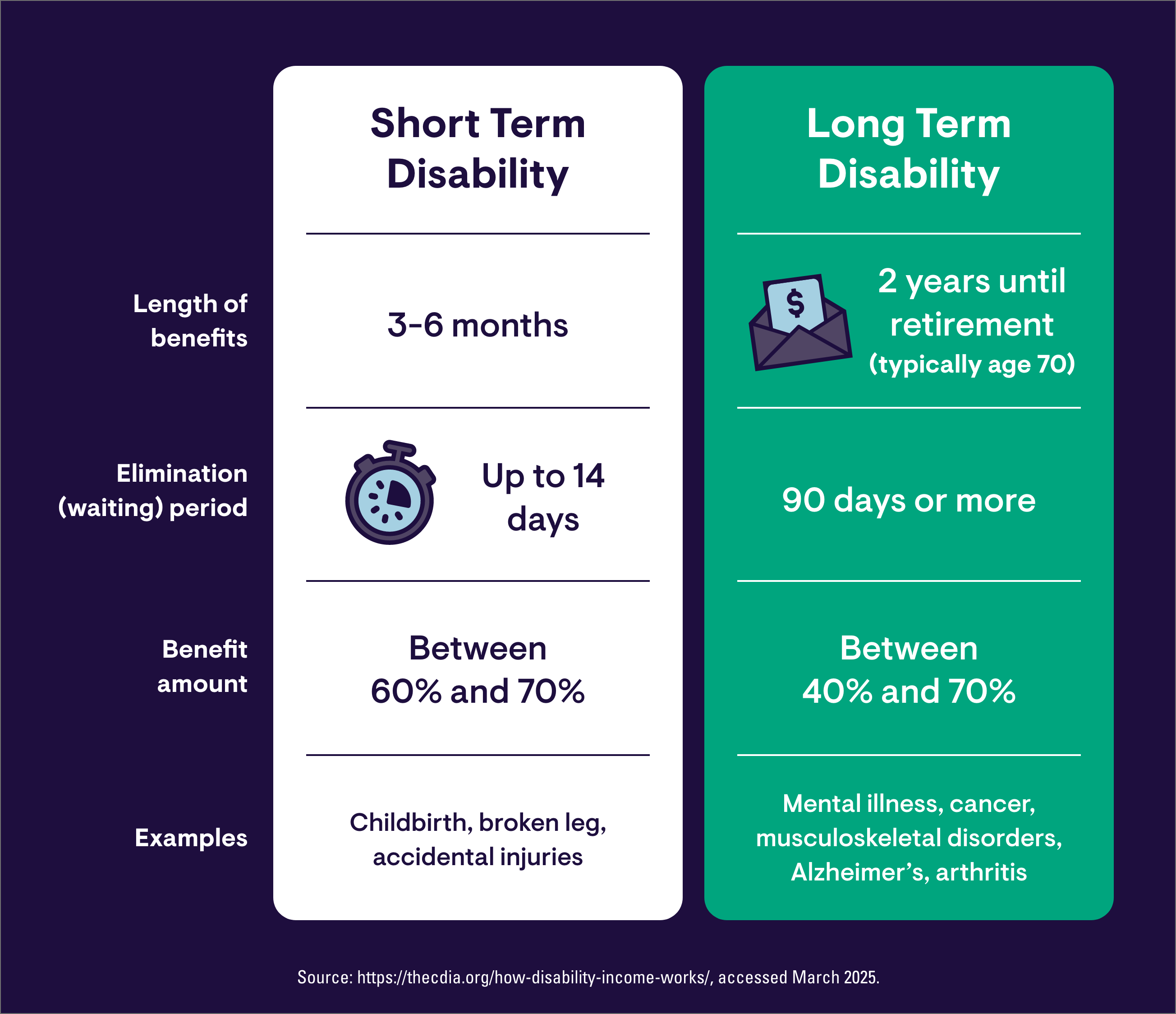

- Short-term disability insurance: Usually protects your income for up to six months—although some policies offer coverage for up to two years. Depending on the policy, short-term plans typically replace between 60% and 70% percent of your pay. The waiting period is around two weeks; however, the duration of coverage is shorter than that offered by long term disability coverage.

- Long-term disability insurance: Offers coverage for an extended period, potentially until retirement. Long-term plans typically cover between 40% and 70% of your income. The waiting period is usually around three months; however, the duration of coverage is much longer than that offered by short term disability coverage.

What are disability insurance waiting periods?

A waiting period, also known as an elimination period, is the time between the onset of your disability and when your benefit payment begins. Benefit payments will only start once the elimination period has been met. A longer waiting period usually means lower premiums, while a shorter waiting period offers benefits sooner. As part of your evaluation, you should consider which waiting period may help you effectively manage expenses and minimize financial stress.

For recurring or successive disabilities, if you are out of work and then attempt to return to work but find that you are still unable to work due to the same condition, the waiting period typically does not start over. The allowable period between these instances can differ; for example, the waiting period would be six months with the AICPA Long Term Disability Insurance Plan.

What does disability insurance cost?

Disability insurance can be affordable, but varies depending on your age when you apply, the options you select, and how much coverage is needed to help to protect your income. For example, $5,000 in monthly coverage through the AICPA Long Term Disability Plan can cost as low as $25.50/month*—with no proof of income required.**

How much disability insurance coverage should I consider?

The first step in deciding how much disability coverage you may need is to determine how long you could maintain your current lifestyle without continued income.

Consider the following:

- Evaluate your current financial situation - including your monthly expenses, debts, and savings - to get a clear picture of your financial stability.

- Find out what disability benefits are available through your employer, and if they’re voluntary or employer-paid. Understand how much of your income would be covered and identify any income gaps that need to be filled.

- Assess your financial sustainability and consider if you would need to dip into your emergency funds or make cuts to your discretionary spending to maintain your lifestyle.

Our Disability Needs Estimator can help you determine your coverage needs.

Is employer-provided disability coverage enough?

Disability insurance should be a key part of any financial plan, and while an employer-paid plan is a good start, they typically only cover a portion of your income. Getting a policy on your own, or through the AICPA Member Insurance Program, can supplement any existing coverage to help close the gap in the amount of income you have. Plus, you get the benefit of keeping your disability coverage up to age 70 even if you retire or change employers, and the flexibility to adjust your coverage as needed - not just during open enrollment periods.

Disability insurance for firm owners and sole proprietors

If you are a sole proprietor, your business could be impacted if a disability or illness prevents you from working. Here’s how disability coverage can help:

- Income protection and added financial stability to cover your personal needs, allowing other financial resources to be directed toward your business.

- Greater flexibility and freedom in financial decision making, reducing the pressure of balancing personal and business financial concerns.

- The ability to focus on the recovery without the added stress of business financial concerns.

Important details to consider when choosing disability insurance as a sole proprietor:

- Be prepared to provide proof of earnings to qualify (some policies don’t require this).

- Look for policies that include an own-occupation definition of disability that pay benefits if you can’t return to your own specific occupation.

- Explore policies that offer both total and partial disability coverage, allowing you to continue working part-time while receiving benefits if you’re under a doctor’s care.

When is the best time to get disability insurance?

Disability insurance is essential at every age and stage of life. While young people often don't consider the possibility of becoming disabled, accidents, illnesses, and injuries can strike anyone at any time. Being prepared can make all the difference in the world.

Do I need to take a medical exam when applying for disability coverage?

When applying for disability coverage, you may need to undergo a medical exam or answer a health questionnaire. With AICPA Long Term Disability, you could qualify for instant approval by answering just a few health questions.

A few tips:

- Be completely transparent about your health history and list all medications to prevent any issues with your application.

- For higher coverage amounts, you’ll typically need to provide proof of income, usually based on your prior earnings from federal tax returns; however, be sure to review exactly how ‘monthly income’ is defined for the plans you are considering.

Conclusion

Applying for disability insurance isn’t as daunting as it may seem. In fact, the right disability plan can help give you peace of mind knowing you have the financial support you may need.

The AICPA Long Term Disability Insurance Plan, issued by The Prudential Insurance Company of America, offers:

- Opportunity for instant online approval for up to $12,000 in monthly coverage—up to $5,000 without proof of earnings.

- Group-negotiated rates to help make coverage more affordable.

- Own occupation benefits if you can’t perform the duties of your job, so you won’t be forced into another line of work.

- Two Plan options: Total Disability Option and Total & Partial Disability Option, which allow you to work part-time while qualifying for benefits.

- Coverage you can keep and change any time as long as you remain a member - even if you change jobs or retire.

Use the AICPA Disability Insurance Needs Estimator to help determine how much coverage you may need, or speak to a dedicated representative who can answer your questions at 800.223.7473, Monday-Friday 8:30am-6:00pm EST.

*Rate quote based on the Total Disability Option with a 26-week waiting period for a 34-year old AICPA member.

**If you go out on claim and are working part-time, then you will need to verify your earnings.

IMPORTANT NOTICE — Please visit www.cpai.com/mib.

Not for use in New Mexico.

Not for residents of New Mexico.

This site may contain marketing language, on products issued by The Prudential Insurance Company of America, that has not yet been approved in all states.

This policy provides disability income insurance only. It does NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators, and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. If there is a discrepancy between this document and the Booklet-Certificate/Group Contract issued by The Prudential Insurance Company of America, the Group Contract will govern. In Washington, the controlling document is the Certificate, not the Contract. Contract Series: 83500

1086845-00001-00