Why do I need life insurance?

Especially if you’re young or healthy, it’s easy to understand why you might question whether you really need life insurance; after all, your risk is likely pretty low. But while it’s true you never know what’s going to happen in life, life insurance is about more than simply helping to protect the risks of this moment. It’s a critical part of financial planning that can help to provide peace of mind, financial protection, and long-term benefits for both you and your loved ones.

Understanding life insurance

At its core, life insurance is just that: insurance for your life. When you have a life insurance policy, you can choose one or more beneficiaries to receive a payout for your benefit amount, should you pass away.

However, while all life insurance aims to serve the same purpose, there are multiple types of plans that work differently to meet varying levels of comfort, budget, and personal preferences. As you consider life insurance, the following information explores policy types available through AICPA membership, as well as other sources.

Term Life

Term life insurance provides coverage for a specific number of years—aka, the term. If the insured person dies during the term, the beneficiaries receive a payout, known as a death benefit. If the term ends and the insured is still alive, the policy expires with no payout.

Term life is generally more affordable than other types of life insurance, making it a popular choice for those who need coverage for a set period, such as until their children are grown or a mortgage is paid off. It’s straightforward and easy to understand, and generally does not have a cash value component. Premiums are usually fixed for the term’s duration but may increase if the policy is renewed or, in the case of a step rate plan, if the policyholder enters a new age band. Some term policies are also “convertible”, offering the policyholder an option to change to a permanent policy without needing to undergo a medical exam.

Whole Life

Whole life insurance, sometimes called “permanent life insurance”, provides lifelong coverage, as long as the premiums are paid.

Unlike term life, whole life policies accumulate a cash value. Premium payments are fixed, and a portion of each premium payment helps to build cash value based on the insuring company’s formula. Because whole life insurance offers both protection and savings solutions, premiums are typically higher than those of a term life insurance policy.

Universal Life

Universal life insurance combines a death benefit with flexibility and a savings component. There are several types of universal life insurance that offer different levels of flexibility, growth potential, and risk. Generally speaking, policyholders can adjust their premium payment amounts to fit their changing financial needs, without needing to buy a new policy, making universal life insurance particularly appealing for people with fluctuating incomes or varying financial goals. Additionally, growth within the policy is tax-deferred.

Variable Life

Variable life insurance is a type of life insurance that allows policyholders to invest the cash value in a variety of subaccounts, including equity, bond, and money-market portfolios. The death benefit and cash value can fluctuate based on the performance of these investments, offering the potential for higher returns, but with it, greater risk. Policyholders have the flexibility to choose and manage their investment options, making it suitable for those with a higher risk tolerance and investment knowledge.

Variable life insurance can be an attractive option for those looking to combine life insurance with investment opportunities, providing both protection and the potential for financial growth.

Why should you consider life insurance?

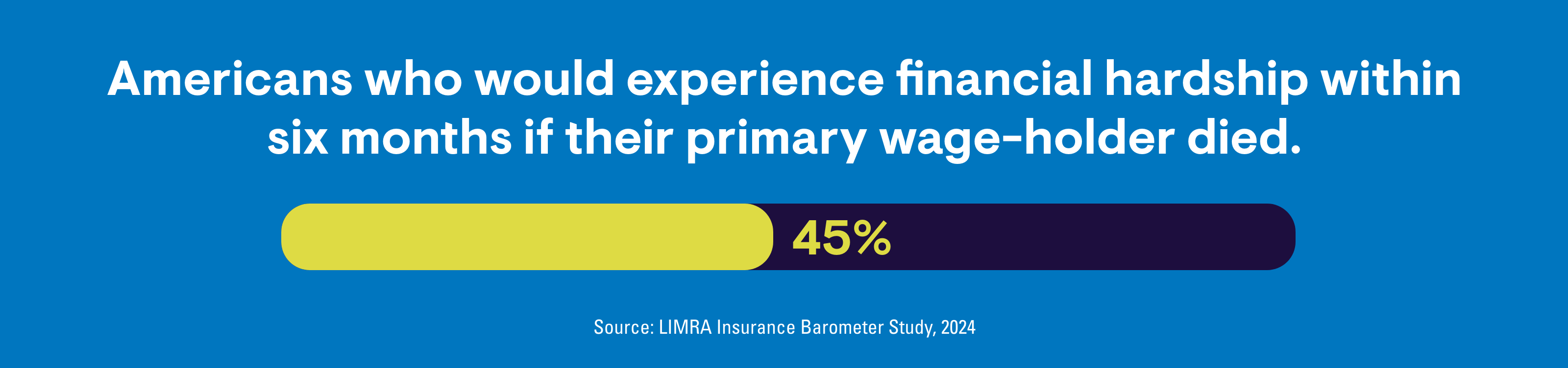

While only you can determine your exact needs and risk comfort level, there are many ways life insurance may benefit you and the people you would leave behind.

Financial protection for your family

One of the most common reasons to have life insurance is to help provide for those you might leave behind. Life insurance does this in two ways, through death benefits and living benefits.

Death benefits

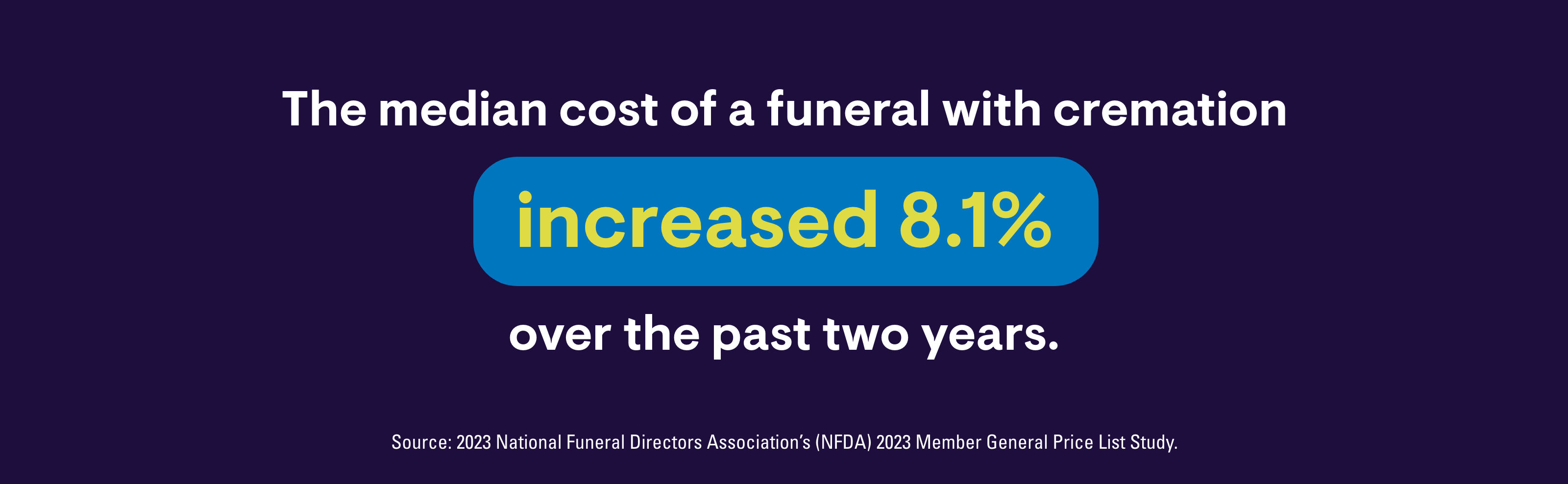

The payments to beneficiaries following a policyholder’s death can provide much-needed support during a challenging time. These funds can help cover a multitude of funeral and burial-related costs, such as a funeral home, casket, burial plot, grave marker, transportation, and even floral arrangements. Payments can also help with outstanding debts, including credit cards, a mortgage, and student loans, to lessen any inherited financial burden.

Living benefits

In some cases, the policyholder may need to access their benefits while they are living. For example, many term life policies will pay an accelerated death benefit if the insured faces a terminal illness. Other policies may allow for cash withdrawals or other ways to tap into the death benefit to help pay for long-term care expenses insurance doesn’t cover.

How does life insurance help protect your assets?

Life Insurance can help protect the people you leave behind—as well as the more tangible legacy you may be working to build.

- Mortgage protection: If you pass away, your home will remain. But without life insurance, could your family continue to pay the monthly bill? Life insurance payments can help supplement your remaining family’s income, which could mean the difference between them being able to stay in their home and being forced to sell.

- Business continuity: If you own your own business, when you pass, that business could be put at risk. Life insurance payments can help to repay any outstanding business debts, cover operational costs, pay employees, and pay other business expenses to maintain business as usual (as possible) until a successor or buyer is found.

- Estate planning: Estate taxes can be substantial, and life insurance payments can go a long way towards covering them and ensuring liquidity.

What are the tax benefits to life insurance?

While life insurance payments can qualify as income, the payments and/or your contributions can have tax advantages:

- Death benefits generally pay tax-free to beneficiaries, including individuals and named charitable recipients

- Cash value usually grows tax-deferred

Other than financial support, how can life insurance affect you?

Beyond financial support, life insurance can help provide peace of mind.

By proactively securing a life insurance policy, you may be able to regain some sense of control around your family’s future, rather than waiting for life to happen and then leave them to react. Knowing you have a plan can also help reduce stress and anxiety for you and your loved ones.

Is life insurance flexible?

While each insurance carrier offers a variety of options, there are numerous ways to make your policy better align with your personal needs and preferences.

Riders and add-ons

When you purchase insurance coverage, you may also have access to a variety of riders and add-ons that can provide additional, specific coverage or benefits. For example:

- An Accelerated Death Benefit Rider provides the policyholder access to a portion of their benefit should they receive a terminal illness diagnosis.

- A Waiver of Premium prevents the policy from lapsing—without the policyholder needing to continue paying premiums—if they become disabled and unable to work.

Convertible term policies

Life is full of choices, and what works best for you now may not meet your needs 10 years down the road. Convertible term life insurance policies have built-in provisions to enable that change, offering policyholders a way to convert their term life insurance to a more permanent policy—often, without undergoing a new medical examination. This usually comes with a predetermined conversion window and can be done without requiring an underwriting process.

Adjustable policies

Once you have coverage, the life insurance policy may allow you to make changes within your policy to accommodate shifts in lifestyle and needs. This could include a change in your premium payment or death benefit.

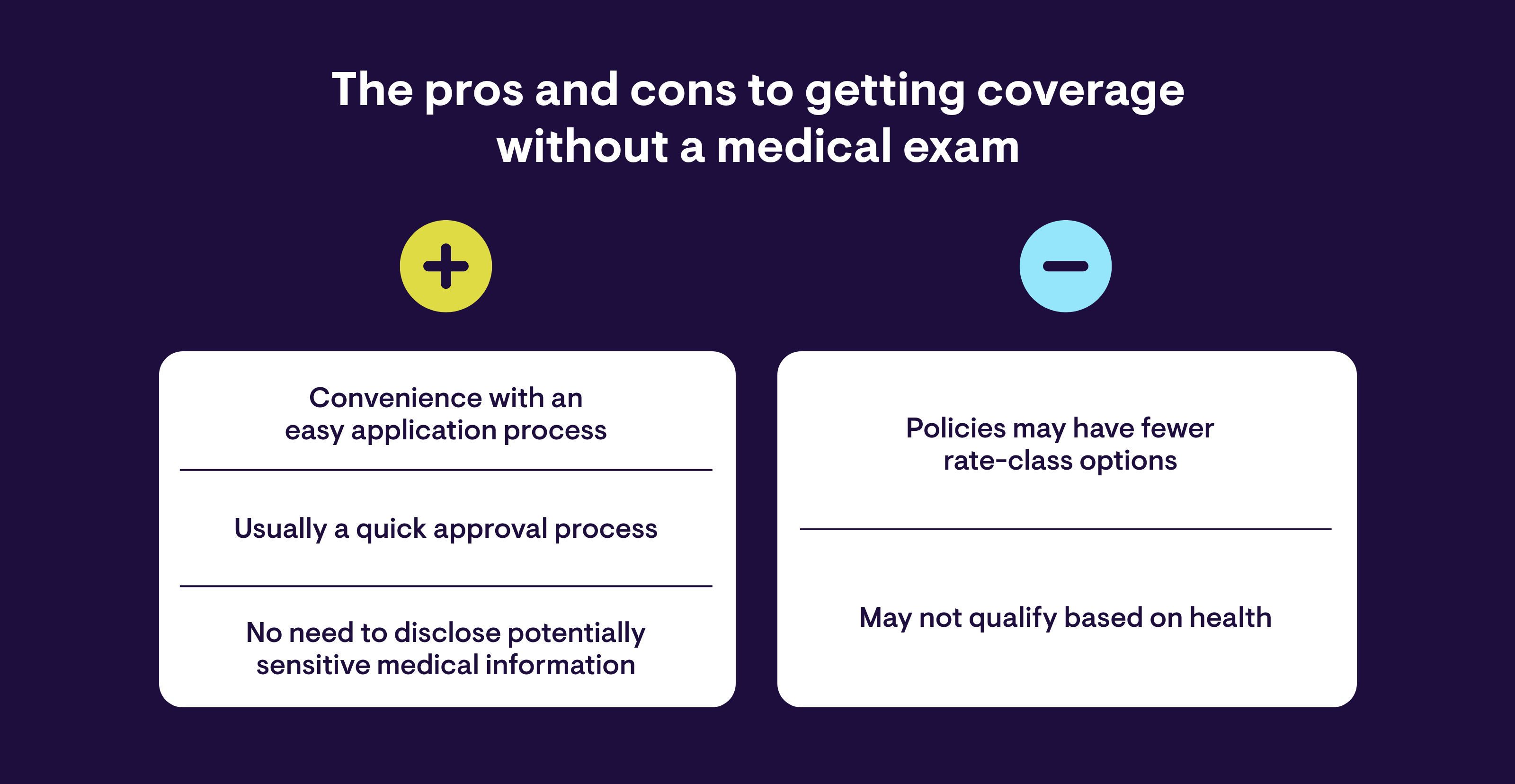

Can you get life insurance without a medical exam?

As part of the life insurance application process, you’ll usually need to answer a few health-related questions, and in some cases, you’ll need to complete a medical exam that helps the insurer better assess your level of risk. However, not all policies or coverage level amounts require a medical exam. Here are a few of the types of plans that might not require a medical exam to secure coverage:

- Some employer-sponsored plans may not require a medical exam for coverage and provide coverage up to a certain amount of the employee's salary

- Some associations, including the AICPA, offer coverage without an exam—and with instant approval opportunities—depending on the insured's age and rate class.

- Simplified Issue plans usually require the applicant to answer a few questions, but do not require the medical exam.

While there are many reasons to consider securing life insurance through a plan that does not require a medical exam, a few of the more common include:

- Time constraints that limit the applicant from waiting to undergo a traditional underwriting process with a medical exam

- Personal concerns or anxiety about undergoing bloodwork and/or invasive exams

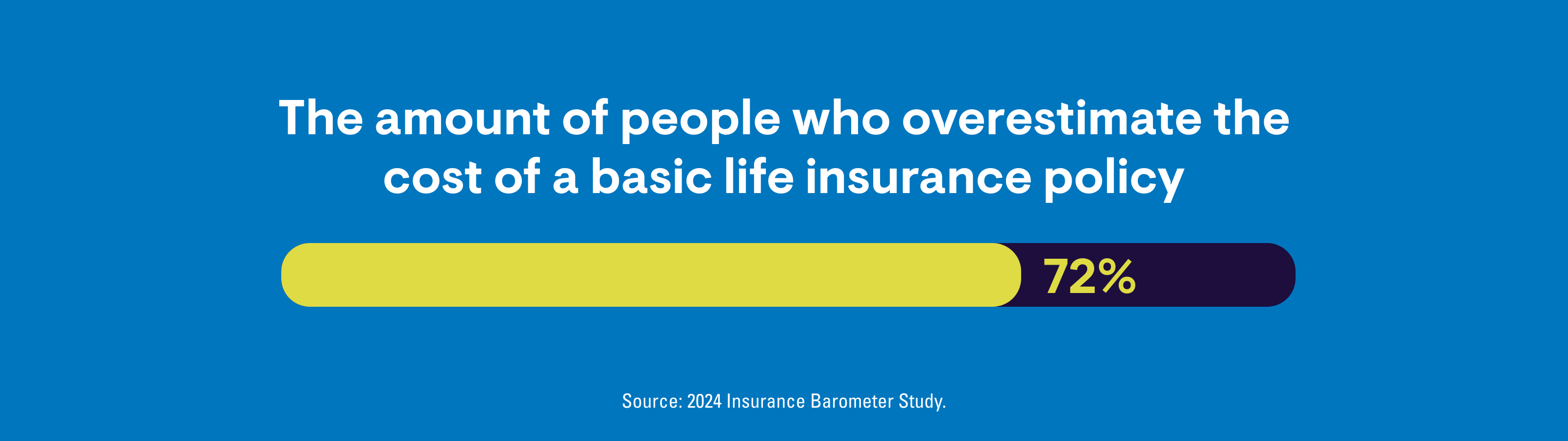

How can I make life insurance more affordable?

Life insurance does have a cost associated, but there are many ways to find coverage that fits your budget.

- Consider the type of plan. Term life insurance is often a budget-friendly option, as it allows you to determine your rate from pre-established rate bands that span a set number of years

- Generally, the younger you are, the lower your rate. By starting your coverage early, you can take advantage of the lower rates

- Live a healthy lifestyle. Life insurance rates are set to correspond to different risk factors. By making healthy choices—like not smoking or partaking in risky activities, for example—you may be able to fit a lower-risk rate profile

- Take advantage of group-negotiated rates. Many times, group-negotiated rates through your employer or associations like AICPA offer you access to lower rates than you’d be able to secure on your own

How does life insurance work in real life?

Hear from AICPA members about their experience with the Plans and application process.

What's Next?

- Keep reading to learn more about life insurance. We’ve included several recommendations at the top of this page.

- Try out our Life Insurance Needs Estimator; it’s a great way to help determine how much coverage you might need.

- While price is an important consideration, remember to also check the carrier rating and provider reviews.

- As you shop and review carrier options, make sure to also review your AICPA Member Insurance benefits.

IMPORTANT NOTICE — Please visit https://www.cpai.com/mib.

Products issued by the Prudential Insurance Company of America may not be available in every state.

Not for use in New Mexico.

Not for residents of New Mexico.

Accelerated Benefit Option is a feature that is made available to group life insurance participants. It is not a health, nursing home, or long-term care insurance benefit and is not designed to eliminate the need for those types of insurance coverage. The death benefit is reduced by the amount of the accelerated death benefit paid. There is no administrative fee to accelerate benefits. Receipt of accelerated death benefits may affect eligibility for public assistance and may be taxable. The federal income tax treatment of payments made under this rider depends upon whether the insured is the recipient of the benefits and is considered terminally ill and/or chronically ill. You may wish to seek professional tax advice before exercising this option.

Aon Insurance Services is the brand name for the brokerage and program administration operations of Affinity Insurance Services, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc. (CA 0G94493), Aon Direct Insurance Administrators, and Berkely Insurance Agency; and in NY, AIS Affinity Insurance Agency.

Group Insurance coverages are issued by The Prudential Insurance Company of America, and Group Variable Universal Life insurance is distributed through Prudential Investment Management Services LLC ("PIMS"). Both are Prudential Financial companies, Newark, NJ.

1089121-00001-00